The sporting world has already adapted significantly due to Covid-19, but few in the sports media sector can claim to know with any real certainty what the industry’s landscape will look like in a post-pandemic world.

According to Stats Perform’s 2021 Fan Engagement Report, though, the technological evolution in sport is set to accelerate, given the ongoing challenge of attracting and retaining enthusiasts in an ultra-competitive entertainment space.

The sports data and analytics company polled more than 150 different sports media and sports-related organisations from a variety of industries, regions and verticals to discover how they have reacted to the Covid-19 challenge and what their expectations are for the coming year and beyond.

The insights gathered through the results underline the scale of change on the horizon.

Changing times

It is little secret that sports media companies, as well as leagues, event operators, clubs and other rights-holders, have pivoted more to digital channels to engage with fans over the past year-and-a-half, given the increasing use of stay-at-home devices in times of pandemic-related restrictions.

However, many organisations appear to have only scratched the surface in terms of technological innovations.

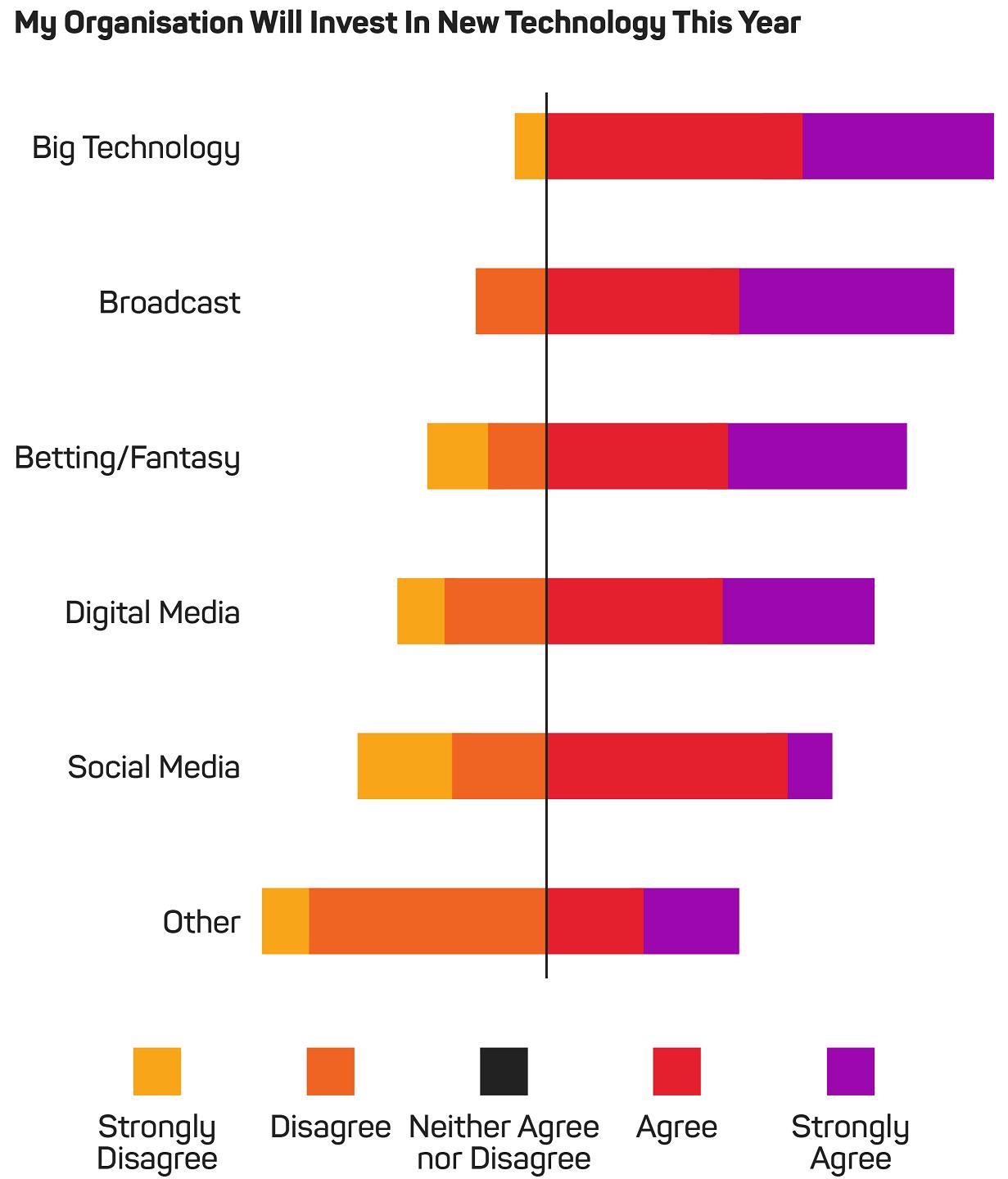

Nearly three-quarters (72%) of respondents said that their organisation is looking to invest in new technology this year – a figure that unsurprisingly rocketed to 93% of tech leaders, followed by representatives of the broadcast, betting/fantasy, digital media and then social media segments.

This appetite tallies with a study released earlier this year by Grand View Research that found that the expansion of the sports technology sector is showing no signs of slowing down, in spite of many organisations having to deal with squeezed budgets due to lower revenues due to Covid-19.

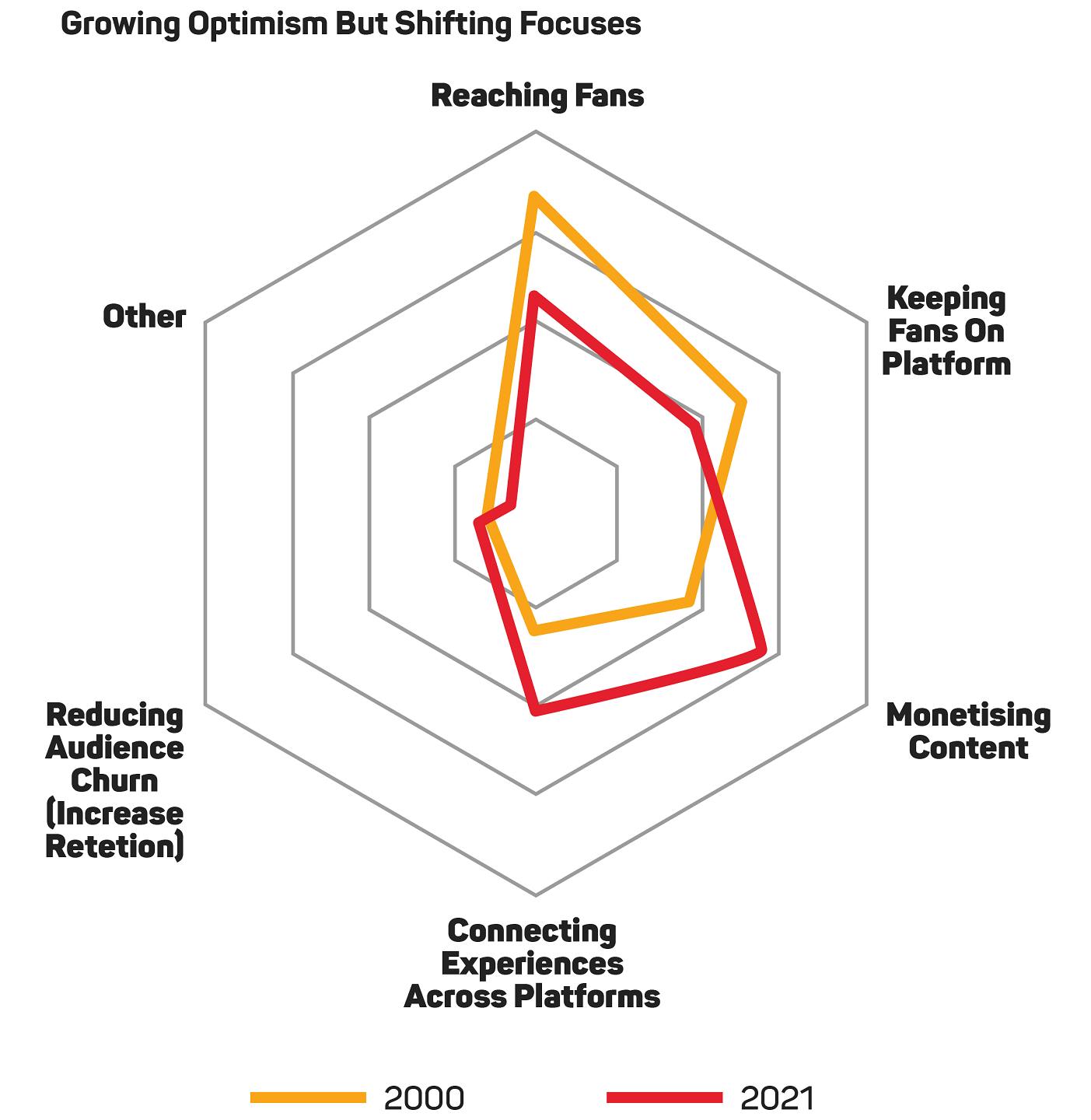

As outlined by the Stats Perform report, there has been a clear shift in focus on technology-related expenditure from reaching fans and keeping them on a platform in 2020 to monetising content and connecting experiences across platforms in 2021.

Coverage challenge

The research broadly found that the breadth and depth of coverage in sport remain critical factors. However, other aspects play a crucial role in fan engagement.

“With the abundance of sports content in circulation, the need to cut through the noise has never been higher,” the report stated. “Whilst content producers can rely on quality and uniqueness to mediate this risk, personalisation offers the chance to cut through that noise.”

From a content perspective, 26% of respondents highlighted in-depth statistics and analysis as the most valued factor by customers, followed by 25% who cited a need to provide a unique voice or perspective. Perhaps surprisingly, ease of access and affordable pricing lagged behind on 17% and 9% respectively.

The report added that digital transformation has created a new breed of sports fan, with digital media becoming the primary driver of fan engagement. As a result, “content creators must create experiences which reflect their expectations”, with the 2021 sports fan being more globally connected, knowledgeable and tech-savvy than ever before by embracing new technologies and data-driven content.

‘Always-on’ content

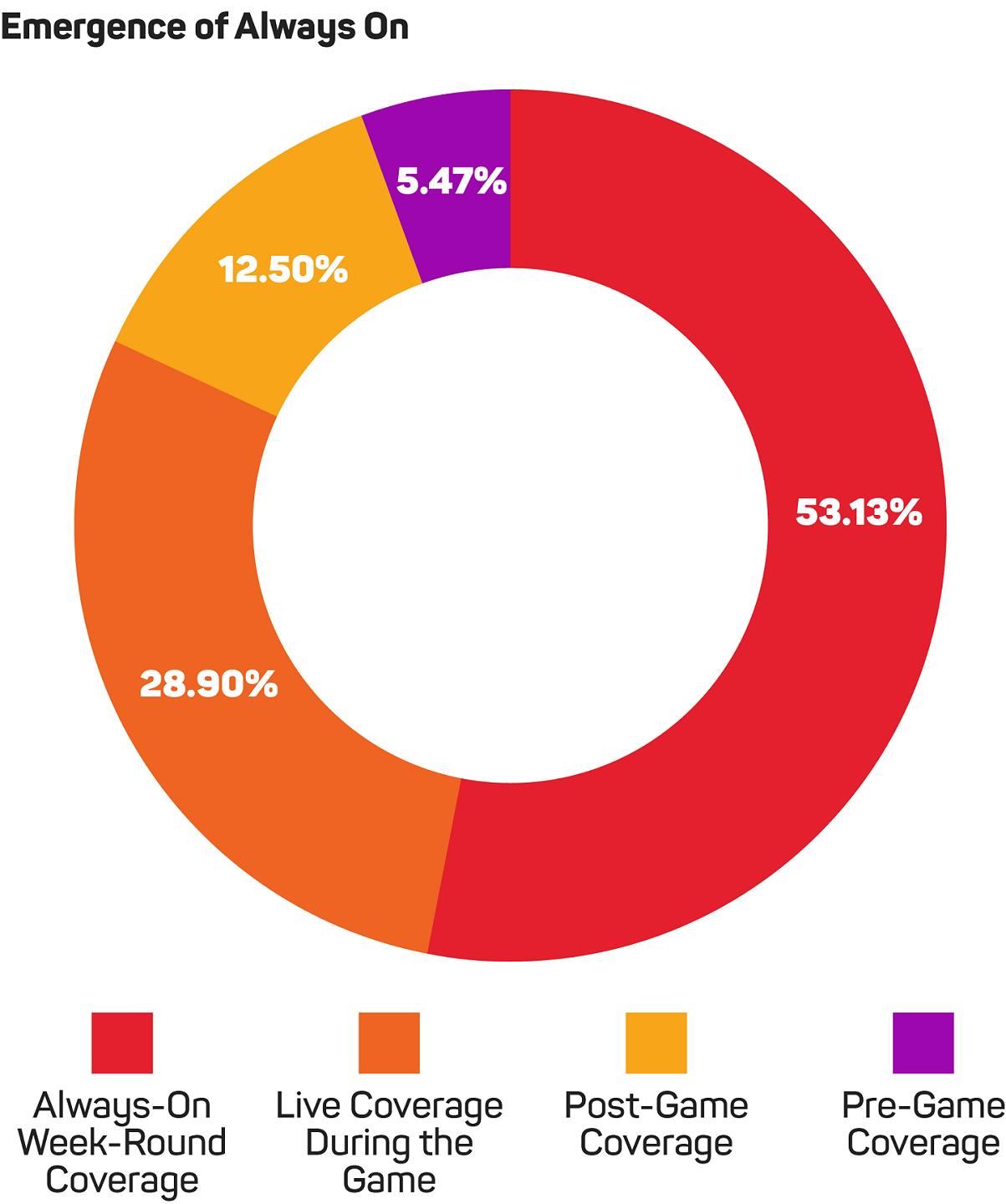

More than half (53%) of respondents underlined a growing opportunity to respond to demand for ‘always-on content’, with digital media prioritising such content over live content.

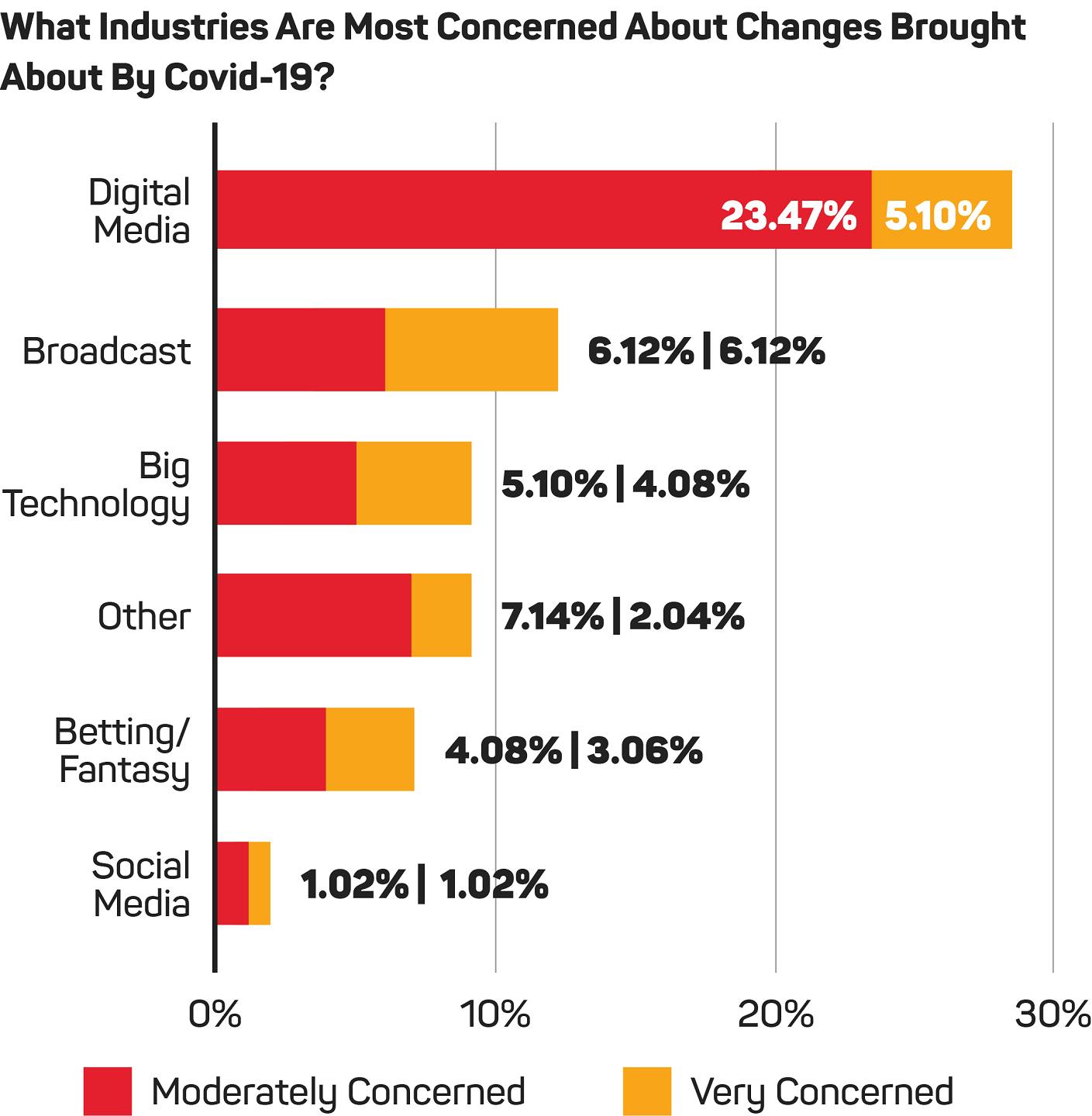

However, this demand has been driven by evolving behaviours from sports fans and, from a broader perspective, respondents from digital media expressed more concern about changes brought about by Covid-19 than any other vertical in the study.

When asked what they saw as the biggest threat to their organisation in 2021, an overwhelming majority of respondents aired concerns about budget cuts, followed by subscriber cancellations in a distant second place.

Consumer expectations are also changing in other ways. For example, 40% of respondents said that they were facing increased pressures from fans to demonstrate moral and social responsibility.

Significantly, 61% of those who participated in the study said that their organisation is moving in a different direction than was initially planned for 2021, while 74% disclosed that Covid-19 has given them new insights into the future of sports and sports media.

Esports

One such direction that has become increasingly prominent in the industry is esports. Facing an unexpected dearth of sporting action in the second quarter of 2020 due to the pandemic, many sports properties – from Spanish football’s LaLiga to the Formula 1 and IndyCar motorsport championships – launched esports competitions.

For many sports organisations, such a move has been irrevocable due the level of interest generated, even with the return of live sport and, gradually, spectators in stadiums. Given that context, it is inevitable that esports will continue to be viewed as a vehicle to drive engagement with new generations of fans.

In the report, esports was cited as the most common new addition amongst respondents when discussing an increase of coverage and growth potential, with half of those polled saying that they were looking to break into coverage of competitive gaming this year.

Half of the respondents who identified esports as a growth opportunity were from digital media, followed by broadcast and the betting/fantasy sectors. The study noted that esports viewing figures are expected to reach 646 million in 2023 – double the total in 2017.

Positive signs

After a tumultuous period for the industry, encouragingly, nearly 84% of respondents said that they feel optimistic about the future of sports media, with the highest level of confidence coming from the digital media sector.

After a tumultuous period for the industry, encouragingly, nearly 84% of respondents said that they feel optimistic about the future of sports media, with the highest level of confidence coming from the digital media sector.

There appears to be a clear sense from industry stakeholders that, having weathered an unexpected storm for a year-and-a-half, opportunities as well as challenges lie ahead in the months and years to come.

“What shines through from the research is that there is a continuing sense of confidence underpinned by fan demand for content,” the report added.

“The next 12 months promise to bring excitement, innovation and a period of real change in sports media.”