DOWNLOAD THE EXECUTIVE SUMMARY

SUMMARY

The report gives you an overview of the market characteristics which have led to the huge growth in investments in sport, and analysis of how this market will evolve in the future. It also looks at a breakdown of investments in clubs, leagues, and federations, by private equity company – as well as in-depth case studies on the most prominent deals.

TABLE OF CONTENTS

SECTION 1

The Market – an analysis of the current marketplace with reasons for influx of private money.

The Deals – tables with the covered active private equity investments, by the value, size of stake and duration of the deal. Deals are broken down by type, whether club, league or federation. The club deals broken down by sport and league. The assets are also broken down by private equity company.

SECTION 2

The Case Studies – 14 detailed case studies covering clubs, leagues and federations, and the major private equity investors in sport. Each case study includes portrait of the relevant private equity investor and its strategy.

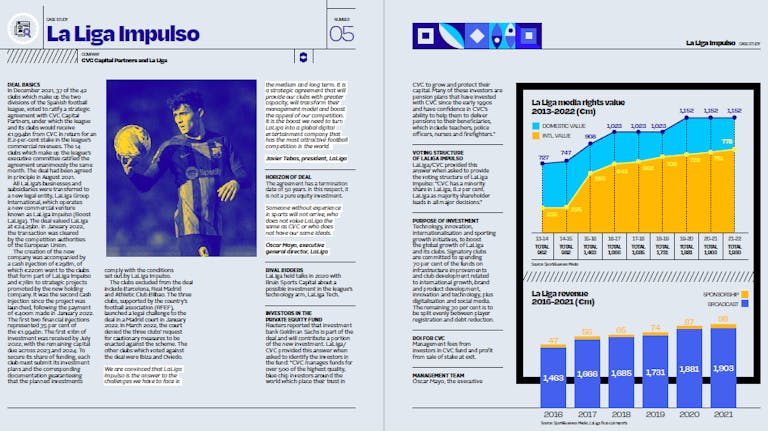

Case studies include: → CVC Capital Partners deals with: • International Volleyball Federation (FIVB) • Premiership Rugby • Six Nations Rugby • Celtic Rugby (URC) • Spanish football’s LaLiga • French Football League (LFP) • Women’s Tennis Association → Silver Lake’s deals with: • New Zealand Rugby • Australian A-League • Ultimate Fighting Championship → Bridgepoint’s deal with MotoGP (Dorna) → Arctos Sports Partners multi-franchise investments in US sports → Dyal Capital and multi-franchise investments in the NBA → Clearlake Capital’s investment in Chelsea FC

SECTION 3

A look forward to the factors which will shape how the market for private equity investments in sports clubs, leagues and federations evolves, looking at market dynamics, the emergence of dominant players, regulatory responses and macro-economic factors such as interest rate rises and the challenges facing the global banking industry.

KEY AREAS

- What factors have led to the recent influx of investment?

- How is the money used to drive growth for sports organisations and maximise returns for the investors?

- Will the US or Europe prove to be more attractive to Private Equity, as the US market continues to open up?

- What are the consequences of the separation of commercial activities from sports governance?

- What is the exit strategy for private equity firms that have multiple sports investments maturing at the same time?

WHY YOU NEED THIS REPORT

- Get an overview of the current market and understand why there has been a recent influx of investment.

- Understand how investments have been managed and the impact on revenue

- Benchmark against competitors and important considerations when debating the pros and cons of investment

- Understand the deal specifics, deal complexities and management implications

- Understand the future outlook for private equity investment in the industry and the long-term implications for the sports sector