DOWNLOAD EXECUTIVE SUMMARY

SUMMARY

The MENA Media Rights Report provides you with a detailed breakdown of key domestic properties’ revenue in the region and an analysis of the value of key international properties.

Also, the report analyses the market in terms of media trends and market developments, including a beoutQ piracy timeline and analysis of the major regional sports broadcasters.

The value of media rights in the Middle Eastern and North African market was just under $1.1bn in 2020, accounting for 2.4 per cent of the total global sports rights market.

This year’s value is a decrease of about 14 per cent on the value of the market in 2019, which was worth about $1.2bn. Unlike other top sports media markets, the bulk of the market value in Mena is mainly driven by the value of international properties. Football is dominant, with eight out of 10 ofthe most valuable properties being international football competitions, accounting for about $777.5m in 2020.

Following on from a blockade imposed on Qatar in 2017 by four Mena countries – Saudi Arabia, Egypt, the United Arab Emirates and Bahrain – beIN has been the main victim of the Saudi supported beoutQ pirate channel. The report highlights the key developments over the last four years from one of the biggest talking points in the sports industry.

TABLE OF CONTENTS

1. Middle Eastern and North African Market and Broadcasters

Analysis of the Mena market from a macro-economic perspective, with focus on media trends and market developments, including a beoutQ piracy timeline. Analysis of the major Mena sports broadcasters, including:

- BeIN Sports

- Abu Dhabi Media

- MBC

- Saudi Sports Company

- Other notable broadcasters

2. Domestic Properties

Analysis of domestic properties’ media-rights revenues across the region, including:

- UAE Pro League

- Saudi Professional League

- Morrocan Botola Pro 1

- Tunisian Ligue Professionnelle 1

- Egyptian Premier League

3. International Properties

Analysis of the most-valuable international mediarights properties in the region, including:

- English Premier League

- Spanish LaLiga

- Italian Serie A

- German Bundesliga

- Uefa Champions League and Europa League

- Uefa European Qualifiers and Nations League

- Asian Football Confederation Competitions

- Fifa World Cup

- Formula One

- Olympic Games

- National Basketball Association

- Australian Open

- French Open

- Indian Premier League

- Cricket Australia properties

- England And Wales Cricket Board properties

- Ultimate Fighting Championship

- World Wrestling Entertainment

KEY FINDINGS

- The value of media rights in the Middle Eastern and North African market was just under $1.1bn in 2020, accounting for 2.4 per cent of the total global sports rights market.

- This year’s value is a decrease of about 14 per cent on the value of the market in 2019, which was worth about $1.2bn. About 97 per cent of the decrease in value was due to media-rights rebates to broadcasters.

- Unlike other top sports media markets, the growth of the media-rights market value in the Mena region over the past decade was mainly driven by the increase in the value of international properties.

- Rights-holders with current agreements worth a combined $500m a season in deals with beIN alone are set to go to market in the Middle East and North Africa in 2021.

- SportBusiness, using real and estimated future rights value in the market, predicts the region’s media rights value will not recover to previous levels.

- Domestic football leagues’ media rights in the Middle East and North Africa have produced significant increases over the past decade for local rightsholders, pushed by the government media strategy of countries like Saudi Arabia or the United Arab Emirates.

WHO IS THE REPORT FOR?

- Broadcasters – understand the value of the media rights in order to effectively budget, or even to plan an acquisitions strategy and discover what competitors are doing.

- Rights holders – keep on top of trends and best practice, plus glean insights on competitors.

- Agencies – discover who is working with who, what they are doing and how much they are spending.

- Technology platforms – needing to understand the progress of technology and streaming media rights.

SportBusiness Media

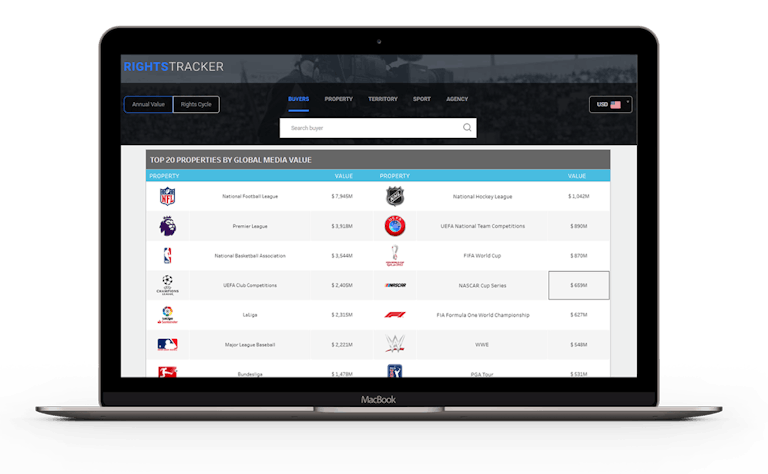

The most accurate data on global media rights deals, plus peerless insight and analysis, on one easy to use digital platform.

- With well over 21,000 media rights deals going back over 20 years

- The most accurate and independent values and durations for major media rights deals

- Analysis and insight around the deals from a team of global analysts

- Every month we provide a detailed data-led snapshot of a particular, sport, geography or industry

- Subscribers also get access to the annual Global Media Rights Report